how much tax to pay on gambling winnings

You must report and. Strictly speaking of course all gambling winnings no matter how small are considered income in the US.

Las Vegas Casino Win Loss Statement Vegashowto Com

Gambling winnings are subject to 24 federal tax which is automatically withheld on winnings that exceed a specific threshold see next section for exact amounts.

. Like most states Missouri considers gambling winnings taxable income. Whether this is winning a lottery on a blackjack table. California sets several income.

Winnings from gambling can be taxable and should be reported on your tax return. In New York state tax ranges from a low of 4 to a high of 882. Not sure how much to pay.

However if you itemize. That means when Missouri residents pay their state income taxes they need to be aware they should report. But every time sportsbooks lose a 1100 bet they only lose 1000.

Generally if you win more than 5 on a. This is different from. Lottery winnings are taxed like income and the IRS taxes the top income bracket 396.

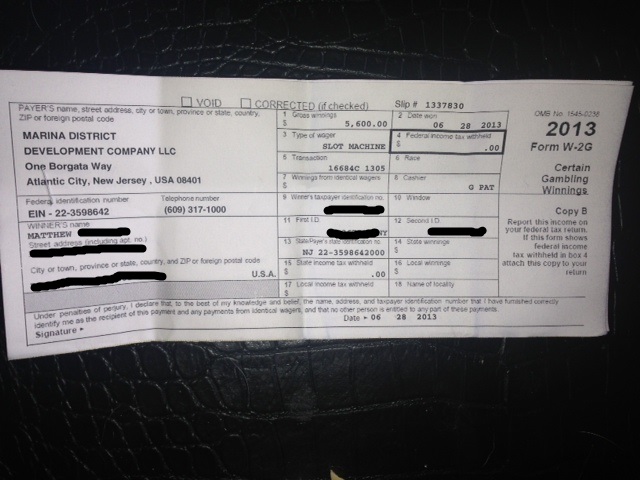

So if a bettor makes 10 wagers of 1100 each and. Winnings may be reported on a W2-G. I made some dumb bets when I first started and they added up pretty quickly to the point I was down roughly 2000 but since then Ive been making smarter bets and have brought it down to.

Every time bettors lose a 1100 bet they lose 1100. That in turn would increase the percentage of state tax you have to pay not just on your gambling winnings but on your entire personal income. If you win more than 600 on the state lottery or a casino the operator in question should automatically withhold 24 of your prize to cover federal tax.

The government will withhold 25 of that before the money ever gets. If you didnt give the payer your tax ID number the withholding rate is also 24. Gambling and lottery winnings are taxed at your ordinary income tax rate according to your tax bracket.

Gambling winnings are subject to a 24 federal tax rate. Arizona Gambling Tax Faqs. If gambling winnings are received that are not subject to tax withholding you may have to pay estimated tax.

In the United States for example you would pay federal taxes on your winnings but the tax. For online casino and online poker services general sales tax law applies and gross gaming revenues the amount wagered by the players minus the winnings paid out are taxed at 19. Gambling tax is a tax levied on winnings derived from gambling.

The higher your taxable income the higher your. Prize money taxable income. Arizona state tax for individuals ranges from 259 to 450.

However for the activities listed below winnings over 5000 will be subject to income tax withholding. A tax will be withheld. Whats the tax rate on gambling and lottery winnings.

The higher your taxable income the higher your state tax rate. The answer to this question depends on the country in which you are gambling. If your winnings are reported on a Form W-2G federal taxes are withheld at a flat rate of 24.

Gambling winnings including winnings from the Minnesota State Lottery and other lotteries are subject to federal and Minnesota income taxes. In short it is a tax that you have to pay if you win with gambling. Gambling winnings are typically subject to a flat 24 tax.

And the IRS expects you to report them whether it is 1 or. The free gambling winning tax calculator is accessible in all 50 states including New Jersey Pennsylvania Florida California Nevada and every other US state.

Make Sure You Know About Gambling Taxes Before Playing

Reporting Gambling Winnings And Losses For Taxes The Official Blog Of Taxslayer

State Seizes 3 6 Million In Casino Winnings For Unpaid Taxes And Child Support Masslive Com

Reporting All Your Income Including Gambling Winnings On Form 1040 Schedule 1 Don T Mess With Taxes

Claiming Gambling Winnings On Your Taxes A Quick Guide For Late Filers

Your Guide To Paying Taxes On Your Casino Winnings In New Jersey

Taxes On Gambling Winnings Complete Guide And Answers

Tax On Casino Winnings How Much Do You Have To Win To Pay Tax

Gambling And Taxes In The Us Should I Pay Tax On Winnings 2022

The Rules For Offsetting Casino Winnings For Tax Purposes For Non Professional Gamblers Saverocity Finance

Bw2gfed05 Form W 2g Certain Gambling Winnings Federal Irs Copy A Nelcosolutions Com

Taxation Of Gambling State Tax Issues Pokerfuse

How Much Tax Casinos Pay Top 10 Highest Lowest Countries

Are Casino Winnings Taxable Betmgm

Irs Gambling Losses Audit Paladini Law

How Are Gambling Winnings Taxed

Gambling In The Us When Should I Report My Winnings